Beyond market volatility, agribusinesses face challenging internal obstacles when it comes to farm profitability, including poor financial visibility, disconnected systems, manual accounting processes, and fragmented data. These challenges prevent farm leaders from accessing the real-time insights needed to make informed decisions. When you cannot see where money flows or identify which operations generate profit, protecting farm profitability becomes nearly impossible.

In this blog, we’ll explore why agricultural financial management is uniquely complex, examine the core ERP modules that transform farm finance operations, and demonstrate how purpose-built solutions drive profitability that generic systems cannot match..

The Financial Pain Points Facing Modern Agribusinesses

Farm financial managers face a unique set of challenges that compound daily, creating operational friction and limiting strategic decision-making capability.

Disconnected Data Across Multiple Systems

Financial data lives in accounting software, operational data sits in farm management platforms, inventory gets tracked in spreadsheets, and sales information resides in separate customer relationship systems. Reconciling these sources for accurate reporting requires hours of manual work each week, delaying insights and introducing errors that distort financial pictures.

Lack of Real-Time Profitability Visibility

Most farms operate in the dark until month-end closes reveal whether operations generated profit or loss. By the time financial reports arrive, opportunities to correct courses have passed. Managers cannot answer basic questions like “Which fields are profitable this season?” or “Are current input costs sustainable at today’s commodity prices?” without extensive manual analysis.

Cash Flow Uncertainty

Seasonal production creates months where cash flows out for inputs and labor while revenue remains months away. Without accurate cash forecasting tools, farms struggle to anticipate shortfalls, negotiate appropriate credit lines, or time major expenditures appropriately. This uncertainty forces conservative financial management that limits growth opportunities.

Manual Processes

Finance teams spend excessive time on data entry, invoice processing, reconciliation, and report generation instead of analysis and strategic planning. These manual processes scale poorly as operations grow, creating administrative bottlenecks that limit expansion capacity.

Inability to Track True Production Costs

Understanding actual cost per acre, per head, or per unit requires connecting field operations, input usage, labor allocation, and equipment expenses. Without integrated systems, these calculations remain estimates rather than precise figures, undermining pricing decisions and profitability analysis.

Compliance and Audit Complexity

Tracking subsidies, certifications, chemical applications, and regulatory requirements across multiple systems makes audit preparation time-consuming and stressful. Documentation gaps create compliance risks that threaten program eligibility and market access.

Core Financial Management Modules in Modern Agriculture ERP

Effective ERP financial management for agribusiness requires specialized modules that address industry-specific requirements while maintaining accounting integrity.

General Ledger (GL)

The general ledger serves as the financial system’s foundation, providing centralized control over all transactions. For multi-location operations, it enables consolidation across different farms, processing facilities, and distribution centers. Farm managers can establish separate GL structures for each field or enterprise, enabling side-by-side performance comparisons that reveal which operations drive profitability and which require intervention.

Accounts Payable (AP) & Accounts Receivable (AR)

Managing cash flow requires precision in both outflows and inflows. AP modules track supplier payments, grower settlements, input purchases, and contractor expenses while automating payment schedules to optimize cash positions. AR functionality monitors customer invoices, contracts, and collection activities, reducing days sales outstanding and improving working capital.

Budgeting and Forecasting

Seasonal agriculture demands predictive financial planning. Budgeting modules enable farm managers to project revenues and expenses based on planted acreage, expected yields, and market price scenarios. This forward-looking capability supports resource allocation decisions, financing arrangements, and strategic planning. Managers can model different scenarios to understand how changing market conditions or operational adjustments impact financial outcomes.

Cost Accounting

Understanding true production costs separates profitable operations from money-losing ventures. Cost accounting functionality tracks expenses at granular levels, by field, crop variety, production batch, or livestock group. This visibility identifies inefficiencies, supports pricing decisions, and highlights opportunities for cost reduction. When you know that Field A generates 15% margins while Field B loses money, you can make data-driven decisions about resource allocation and operational changes.

Asset & Equipment Management

Farm equipment represents substantial capital investment that requires careful financial tracking. Asset management modules monitor depreciation schedules, maintenance costs, and replacement cycles for machinery, vehicles, and infrastructure. By linking asset data directly with financial statements, farm leaders gain accurate views of capital efficiency and can optimize equipment utilization to improve returns on invested capital.

Inventory and Production Accounting

Agriculture ERP integrates operational and financial data for comprehensive inventory control. They track raw materials like seed and fertilizer, monitor in-process inventory as crops grow, and manage finished goods ready for market. This integration ensures inventory values reflect current market conditions while production accounting connects physical outputs with associated costs for accurate profitability analysis.

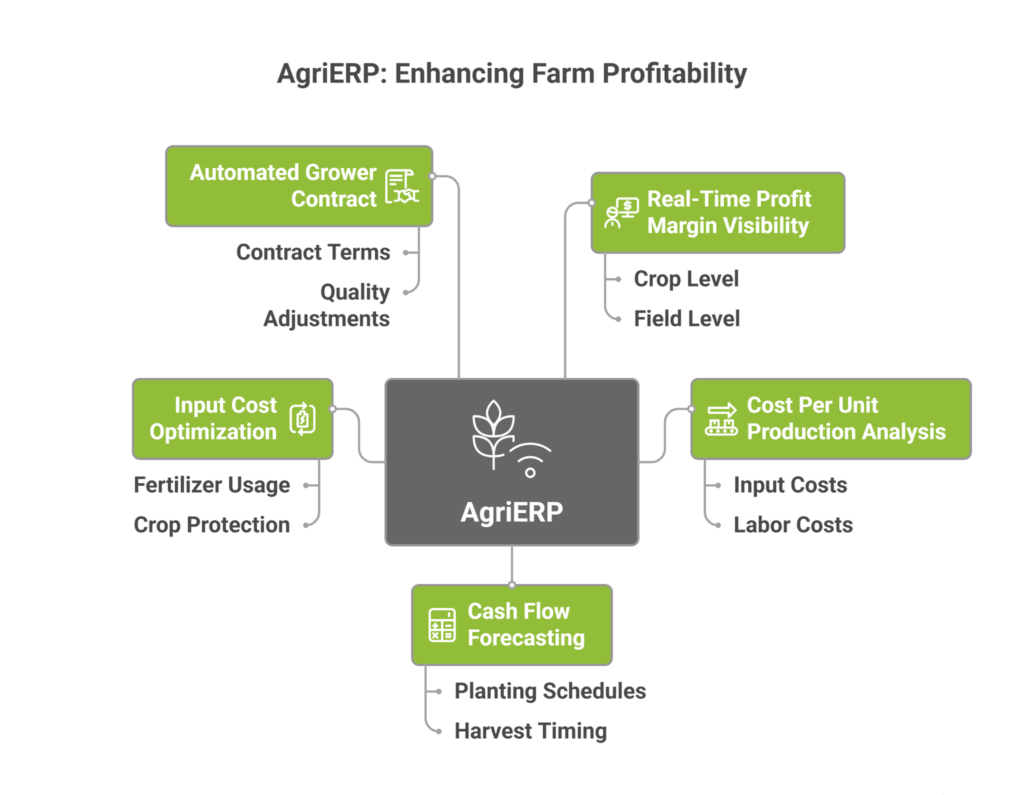

AgriERP: How Agriculture-Specific ERP Drives Farm Profitability Beyond Generic Solutions

How ERP improves farm profitability depends entirely on whether the system understands agriculture’s financial complexities. AgriERP, powered by Microsoft Dynamics 365 platform, represents a purpose-built agribusiness ERP solution that combines enterprise-grade financial capabilities with deep agricultural functionality, delivering profitability improvements that generic ERP systems simply cannot match.

Real-Time Profit Margin Visibility by Crop and Field

Generic ERP systems show overall profit and loss, but AgriERP tracks profitability at the field and crop level. Farm managers can see in real-time which varieties, fields, or production methods generate the highest margins and which drain resources. This granular visibility enables immediate decisions to shift resources toward profitable operations and correct underperforming ones before losses accumulate. The ERP for farm profitability capability connects every seed purchase, fertilizer application, and labor hour directly to revenue outcomes.

Cost Per Unit Production Analysis

Understanding your true cost per bushel, per pound, or per head determines pricing strategy and market timing decisions. Agriculture ERP software automatically calculates production costs by aggregating inputs, labor, equipment usage, and overhead allocation across different crops or livestock groups. This analysis reveals whether current market prices support profitable sales or whether holding inventory makes better financial sense, insights that generic accounting systems cannot provide without extensive manual calculations.

Cash Flow Forecasting Based on Growing Cycles

Agricultural cash flow follows biological cycles, not monthly accounting periods. AgriERP’s farm management ERP functionality forecasts cash needs based on planting schedules, expected harvest timing, and historical yield data. The system alerts managers to upcoming cash shortfalls weeks in advance, enabling proactive financing arrangements rather than emergency responses. This predictive capability accounts for seasonal patterns that generic ERP systems treat as irregular anomalies.

Input Cost Optimization and Waste Prevention

AgriERP tracks input usage against application plans and yield outcomes, identifying waste and overuse that erode margins. When fertilizer consumption exceeds planned rates or crop protection products show diminishing returns, the system highlights these cost drains for immediate correction. The platform’s inventory management connects directly with field operations, revealing exactly where inputs go and whether usage generates proportional yield increases, financial insights that require manual analysis in generic systems.

Automated Grower Contract and Settlement Calculations

For operations that work with contract growers or cooperative members, settlement calculations consume significant administrative time while introducing error risks. AgriERP automates these complex calculations, applying contract terms, quality adjustments, and shared cost allocations accurately. This automation eliminates settlement disputes, accelerates payment processing, and reduces administrative overhead, specialized functionality that generic ERP platforms cannot replicate without expensive custom development.

Real Business Outcomes from ERP-Driven Financial Transformation

While system features matter, business results matter more. Organizations that implement comprehensive farm management ERP solutions report measurable improvements across key performance areas.

- Improved profit margins– Access to current financial data enables proactive management. Instead of reacting to historical reports, farm leaders can monitor margins continuously and adjust operations to protect profitability.

- Better control over input costs and waste reduction– Detailed tracking of seed, fertilizer, chemicals, and feed reveals usage patterns and waste. Farms identify opportunities to optimize input applications, reducing costs without sacrificing yields. Agribusiness owners have experienced a 20% reduction in waste and cost by implementing farm management solution AgriERP.

- Accurate forecasting– Predictive financial models support capital allocation by projecting returns on equipment purchases, land acquisitions, or operational expansions. This analytical capability prevents costly mistakes and directs capital toward opportunities with the strongest financial returns.

- Enhanced compliance and audit readiness – Automated documentation and reporting simplify regulatory compliance. When auditors or certifying agencies request information, integrated systems produce accurate records instantly rather than requiring manual compilation from disparate sources.

- Strengthened cash management- ERP financial management in agriculture systems provide visibility into cash positions, automate collections and payments, and forecast liquidity needs to prevent shortfalls.

Conclusion

Farm profitability isn’t determined solely by what happens in the field. While agronomic excellence and operational efficiency matter immensely, financial clarity proves equally essential. When farm leaders lack real-time visibility into costs, revenues, and cash flows, even well-managed operations can find themselves in financial distress.

AgriERP, powered by Microsoft Dynamics 365, empowers agricultural enterprises to transform financial management from an administrative burden into a strategic advantage. By unifying operational and financial data, automating routine tasks, and delivering real-time insights, these platforms enable farm leaders to make informed decisions that protect margins and drive sustainable profitability.

Speak to an AgriERP expert today to see how Microsoft Dynamics 365 technology can help you master farm profitability.

FAQs

How can I get visibility into profitability for each field or crop?

You need a system that tracks costs (inputs, labour, equipment) and links them to revenue per field/crop in near real-time. A purpose-built solution like AgriERP lets you compare profitability across fields or crops so you can make timely adjustments rather than waiting until month-end.

How can I forecast cash flow given seasonal planting and harvest cycles?

By building a cash-flow model based on planting dates, expected yields, input payments and harvest income. An agriculture-specific ERP uses production schedules to anticipate cash outflows and inflows, helping you plan financing and avoid surprises.

What key modules should I prioritise in an ERP for agribusiness financials?

You should look at modules such as general ledger, accounts payable/receivable, cost accounting, and asset/equipment management. Without these, generic systems may leave you blind to farm-specific cost drivers.

How do I figure out the true cost of production per unit?

You must aggregate seed, fertiliser, labour, equipment depreciation, and overhead at the unit level. An agriculture-tailored ERP like AgriERP automates this by capturing field-level data and allocating costs to production outcomes, enabling accurate per-unit cost and margin analysis.

Can integrating operational and financial data improve farm profitability?

Yes, when you link operational systems with financials you eliminate manual reconciliation delays and errors. That means you get real-time insight, can respond faster, reduce waste and make decisions that protect margins rather than reacting after the fact.

What are the common pitfalls when deploying ERP in agribusiness finance?

Key pitfalls include trying to use generic accounting software without agribusiness context, failing to capture field-level data and inadequate change management. Choosing an agribusiness-ready ERP system reduces customization, aligns with farm workflows and increases adoption.