Get Payroll & HR Module for Microsoft Dynamics

Manage compensation plans, commissions, employee benefits and garnishments, calculate Payroll Frequencies, create & manage Tax Authorities apply to employees or teams, create Tax Reports for Submission and much more with Payroll and HR Module. Get in touch with our consultants now!

For any business, irrespective of its size, payroll processing is one of the most important functions. Payroll processing is a method through which the pay of the employees is calculated by taking certain components into consideration. These components include working hours, benefits, deductions, tax amount and the employment status. This processing requires a lot of time and effort which is not a favorable factor for any business.

The Convenient Way of HR Payroll Processing in Dynamics 365

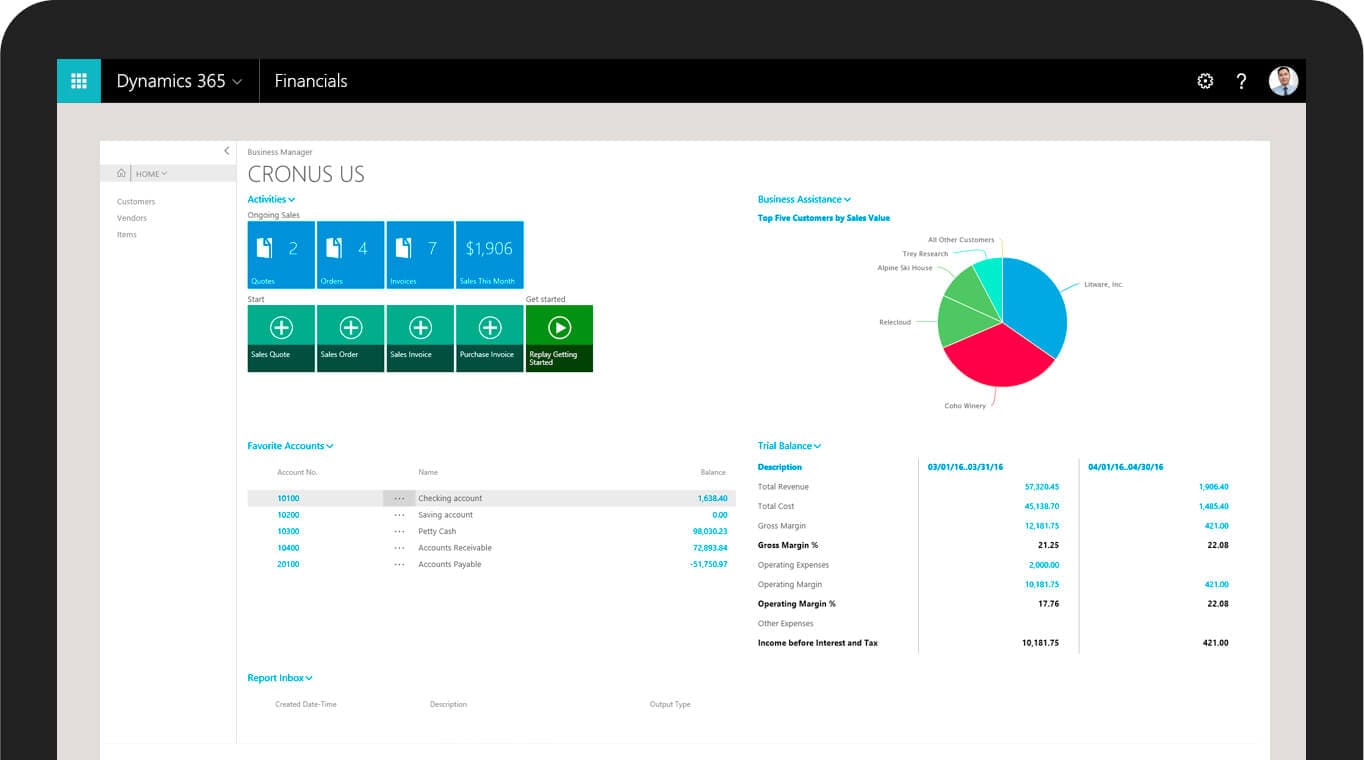

To make HR and payroll processing easier and full of convenience, Microsoft has launched a very promising tool. Dynamics 365 has been launched by Microsoft to simplify the payroll processing burden from the employers and helps them save time and the costs. Dynamics 365 provides businesses with the opportunity to achieve maximum extensibility and flexibility in all their operations relate to HR payroll processing.

Using Dynamics 365 for HR Payroll Processing

Dynamics 365 HR payroll is the perfect solution for businesses who want to save their time and make payroll processing a stress-free function. Here is how you can use this amazing tool for error-less HR payroll processing.

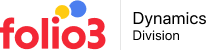

Step 1: Generation and Releasing Earnings Statement

The very first step in Dynamics 365 HR payroll is to create an earnings statement. There are multiple options available to generate earnings statement. One can either use the form in HR payroll module titled as “Generate Earnings” or create each earning statement separately or through integration. After generation of Earnings Statement you can either release the statements separately or you can choose “All Earnings Statements”. And after this step, a pay or earnings statement is generated in Dynamics 365.

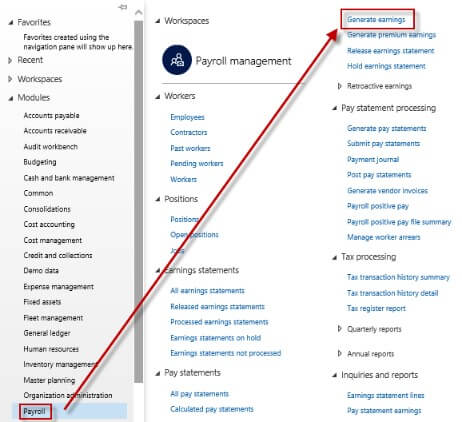

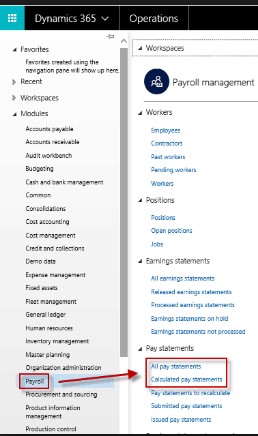

Step 2: Reviewing the Pay Statements

The next step is to review pay statements. In order to open pay statements, simply navigate to the payroll option followed by the pay statements and then choose the calculated pay statements. Here you will be able to see all the details of the employees such as their working hours, earning statement details, benefits, tax and other particulars.

Step 3: Releasing Pay-Statements

After thoroughly reviewing pay statements, the next step is to release these pay statements. There are two ways this step can be completed. One can either release pay statements separately for each employee or through the main grid, they can select multiple pay statements, this is then followed by the submission phase where the user has to choose the Submit for Payment option. Every time this option is selected, a payment journal will be created.

After submitting for payment, a form will appear on the screen in which the user will confirm their submission. This confirmation will post the payment statement at this very instant. A wise approach is not to post the payment because after posting the pay statement, no changes can be made.

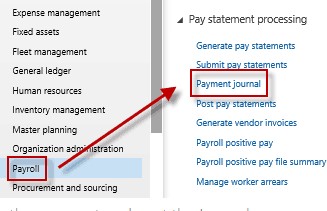

Step 4: Creation of Payment Journal

This step is not carried out by the user but Dynamics 365 itself creates the payment journal. The processing of these payment journals has to be carried out by the user. For this purpose, the user must navigate to the payroll option and choose pay statement processing followed by the selection of the option titled “Payment Journal”. This allows the user to process any journal they want to.

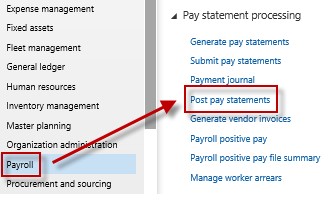

Step 5: Posting Pay Statements

After the processing of the payment journal is done and the payment is made, now you can easily post the pay statements. For the posting of the pay statements the user simply has to go back to the payroll option, choose post pay statements and it is done.

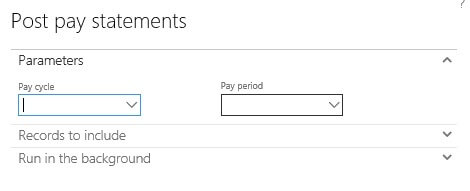

Step 6: Setting the Pay Cycle

Setting the pay cycle is the last step of the entire process, Dynamics 365 HR payroll system will automatically post the pay statements that fall into the criteria set by the human resource department. Here the period is defined to set the pay-cycle.

Conclusion

The Dynamics 365 HR Payroll Processing comprises of six simple steps. This is not just fast but helps a business cut down costs and increase its profitability at the same time. There is still some room for improvement and we have to just wait and see what more improvements Microsoft can make in its tool to make it perfect!