We enable digital transformation for enterprises by implementing dynamics 365 finance and operations to modernize their finance, supply chain, inventory, and business operations.

Microsoft Dynamics 365 Finance and operations is a cloud-based ERP solution built for businesses with complex financial & operational needs. It unifies all processes including finance, supply chain, manufacturing, inventory, and procurement into a single source of truth to provide real-time business intelligence. Powered by Azure, D365 F&O delivers a powerful data-first solution to transform your financial and operating models and achieve real-time data availability and data exchange across applications.

Improve financial controls and deliver valuable AI-driven insights from across your organization to help you reduce cost and optimize spending.

Empower your teams with tools that accelerate business growth and improve your workforce agility, efficiency, and resilience.

Speed up your project lifecycle from prospect, to payment to profits using a single application to manage all project-centric business operations.

Dynamics 365 Finance & Operations (D365 F&O) helps you better align internally, adapt to change, and scale without blowing up your operating costs.

Offer a swift and effective method to record financial transactions, oversee relationship between subsidiary and parent company, handle internal cost accounting, perform currency translations, and generate reports in all supported currencies.Invoice registering and approval process.

Export and import formats for electronic payments while handling multiple currencies and exchange rate adjustment.

Efficiently create and replicate legal entities, define and share comprehensive charts of accounts and sub-accounts across companies, and manage currencies. Additionally, configure journal entries, establish new journals, set up allocation rules, and utilize core reports and business intelligence tools for common general ledger-based reports.

Dynamics 365 Finance and Operations offers comprehensive budgeting capabilities, including flexible configuration options, real-time budget tracking, and customizable workflows for review and approval. It supports detailed budget planning with a flexible chart of accounts and dimensions, user-defined process configurations, and integration with Microsoft Excel for creating budget planning worksheets.

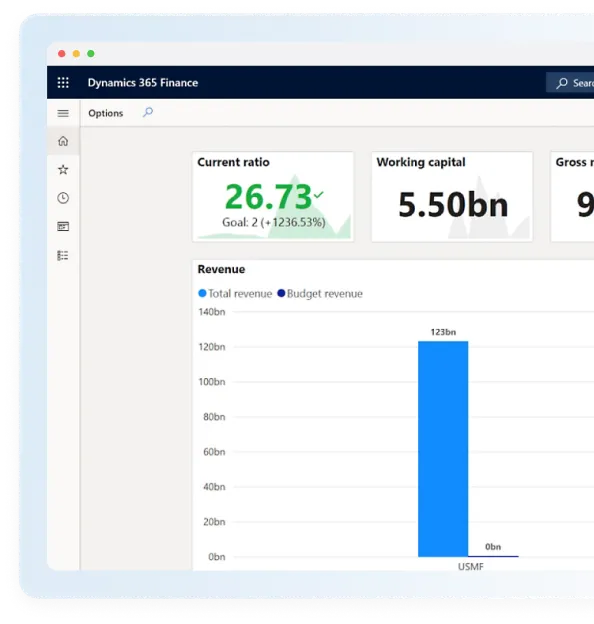

Dynamics 365 F&O lets you create, maintain, deploy, and view financial statements. The platform supports real-time data integration, customizable report design, and collaboration, ensuring accurate and insightful financial analysis.

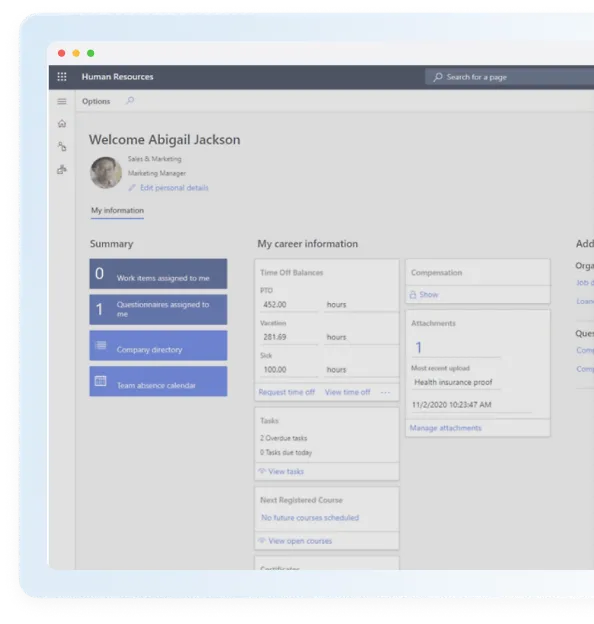

Dynamics 365 Finance and Operations helps you build a vibrant workspace by managing routine recordkeeping tasks and automating processes related to staffing such as talent acquisition and onboarding, benefits administration, training, change management and performance reviews.

Dynamics 365 provides a centralized platform for managing the onboarding process, ensuring that new hires receive a smooth and consistent experience. Customize your employee management approach to suit your unique needs and timelines.

Manage all interconnected business processes involved in employee performance and growth such as defining performance & reviews procedures, learning & succession planning, and maintaining a repository of skills & competencies.- all within Dynamics 365 F&O employee portal.

Dynamics 365 Finance and Operations offers a unified platform that streamlines worker compensation, benefits, and payroll processes. Stay compliant with labor laws, regulations, and accounting standards with real-time updates. Eliminate repetitive tasks and manual data entry to reduce errors and save cost.

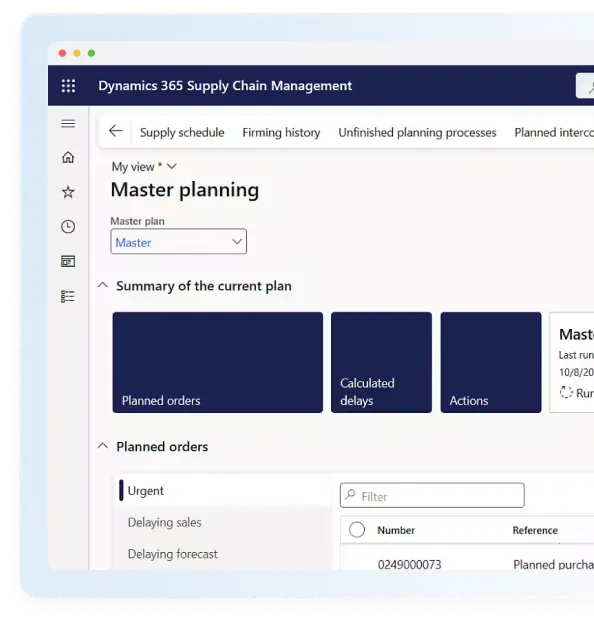

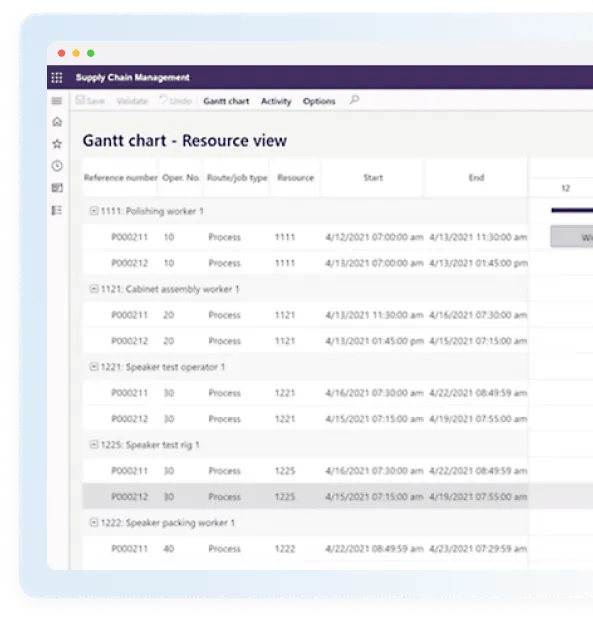

Navigate supply chain disruptions with AI-powered insights. Gain complete visibility into your supply chain by connecting sales and purchasing processes with logistics, production, and warehouse management with Dynamics 365 F&O supply chain module. D365 F&O supports inter-company and multi-site operations, enabling effective management of distributed organizations.

With AI and machine learning, D365 F&O enhances demand forecasting, automates material requirements planning (MRP), and enables real-time inventory optimization. It helps ensure accurate demand prediction, reduce stockouts, and improve overall supply chain efficiency.

Dynamics 365 finance and operations allow organizations to automate and optimize procurement workflows including supplier selection and negotiation, purchase order management, and invoice reconciliation, reducing costs and improving supplier relationships.

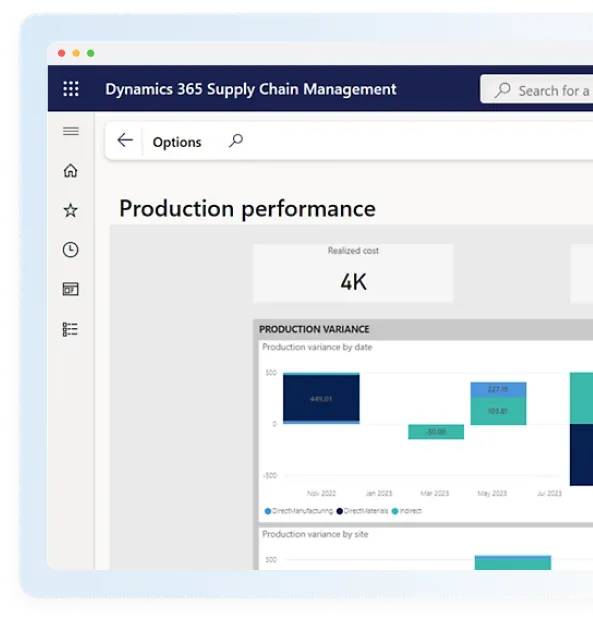

Dynamics 365 F&O supports discrete, process, and lean manufacturing strategies, helping businesses improve quality control, reduce downtime, and integrate external manufacturing execution systems for better visibility. Microsoft Dynamics integrates with your existing systems, unifying entire manufacturing processes while minimizing your total cost of ownership.

Dynamics 365 finance & operations provides comprehensive production planning and control capabilities. It supports multiple scenarios including engineer-to-order,make-to-order, and make-to-stock with real-time tracking into production schedules, material requirements, and resource allocations.

Leverage D365 F&O to optimize workflows, reduce bottlenecks and improve productivity through real-time shop floor activities monitoring such as machine utilization, labor productivity, and production progress.

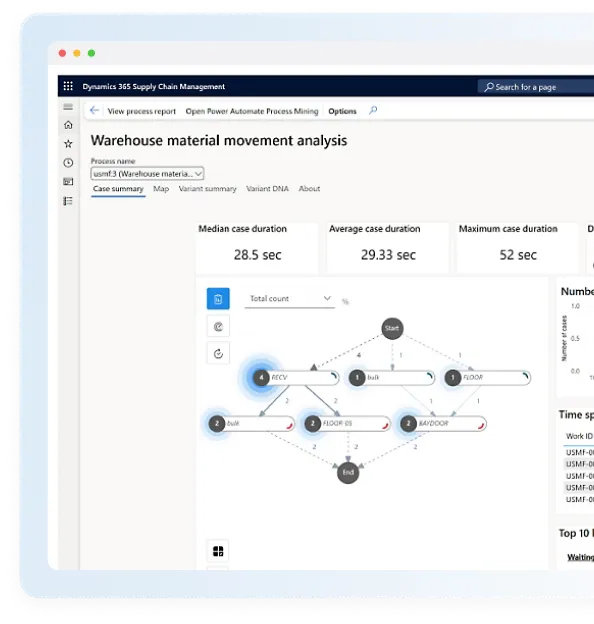

Transform your warehouse efficiency with Dynamics 365 F&O. Automate workflows, integrate with robotics, unlock real-time insights, and manage your operations through a Mobile. Gain real-time AI-powered analytics through PowerBI to ensure timely and accurate order fulfillment while minimizing process inefficiencies.

Manage receiving and shipping processes with advanced algorithms, multiple warehouse zones, and replenishment strategies to ensure efficient material handling within D365 F&O.

Track every item across various dimensions such as site, warehouse, pallet, location, batch, and serial number, providing detailed visibility into inventory status.

Better manage your crucial assets including machines, equipment, and human resources, with Dynamics 365 finance & operations Asset management module. Manage all assets and jobs while staying in sync with your finance & operations departments.

Create work orders, assign resources, register consumption, and track progress against each work order through advanced capabilities of Dynamics 365 F&O.

Schedule work orders jobs, asset management, and maintenance work orders in advance by creating a schedule calendar within Dynamics 365 F&O.

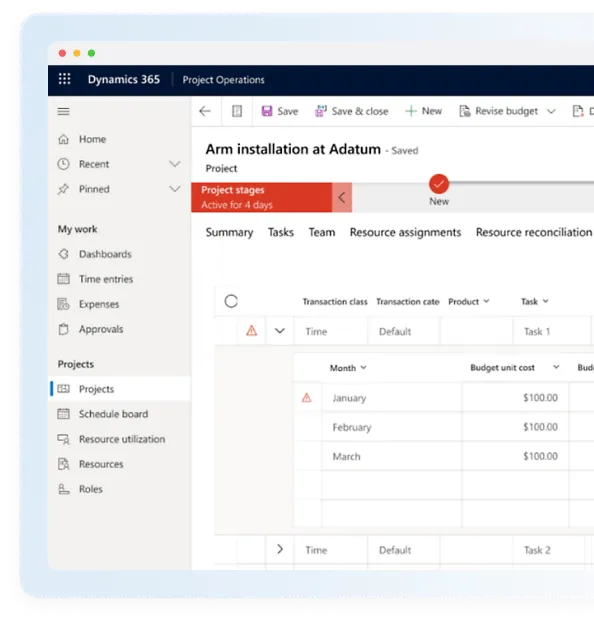

Confidently create project plans, simplify activities, allocate resources, manage budgets, and monitor progress to lead your projects to success with the project management module within Dynamics 365 finance and operations.

Communicate estimated labor, expenses, and material to the customer through project quotation, and record billing terms, limits and agreements in a project. Create a Work breakdown structure and setup budgets and forecasts to guide execution.

Leverage timesheets, expense reports, and other business documents to record and manage work and prepare a detailed analysis of the project. Track budget consumption, procure material, and bill customers with Dynamics 365.

Evaluate your project success or failure based on multiple parameters such as expense reports, inventory transactions, allocated budgets, utilisation rate, and success rate.

Dynamics 365 finance & operations offers powerful AI-powered business intelligence capabilities providing real-time insights into your business performance including financial reports and operational data. It integrates with PowerBI as well as other Microsoft & external data sources enabling data consolidation and offers a consolidated view.

Dynamics 365 F&O offers robust role-based security to protect sensitive data including data protection features like encryption, data masking, and audit trails.

D365 offers both on-cloud and on-premises deployment options providing organizations with the flexibility to meet their unique needs. D365 is designed to be scalable along with your business needs and supports business continuity and disaster recovery.

Microsoft understands the ever-changing business landscape. Starting as a simple accounting software, D365 F&O now serves as the backbone of enterprises managing all key aspects of the business. To better serve the audience, Microsoft Dynamics 365 Finance & Operations has been split into 2 applications; Dynamics 365 Finance and Dynamics 365 Supply Chain Management. Below is the breakdown of the key functionalities of both.

Dynamics 365 finance is an ERP solution offering a comprehensive view of your company’s financial health. It offers real-time visibility into key processes and tools to increase productivity , reduce operational costs, and predict future outcomes.

D365 Supply Chain Management is also an ERP solution built for manufacturers, distributors, and retailers to support the flow of goods or services and build resilient and intelligent supply chains from purchasing the raw materials to delivering the final product to the customer.

Copilot is here to simplify your interactions with the complex yet powerful Dynamics 365 ERP ecosystem. Users can now leverage Copilot within Dynamics 365 Finance & Operations for support and simplify their complex financial processes.

Eliminate recurring and laborious tasks by letting AI handle that for you so you focus on higher value tasks.

Uncover hidden patterns and trends within your financial & operational data through AI-powered insights. Identify financial problems fast and resolve them faster to build a healthy cash flow.

With 24/7 available chat functionality, users can interact conversationally with their financial & operational data and pull any piece of information without having to navigate through complex system menus.

Copilot works as your AI partner for support and productivity, providing insights and solutions to every problem or bug you encounter in your journey within Dynamics 365 F&O.

| D365 Finance | D365 Finance Premium | D365 Supply Chain | D365 Supply Chain Premium | |

|---|---|---|---|---|

| Base user price/month | $210 | $300 | $210 | $300 |

| Attach user price/month | $30 | $30 | $30 | $30 |

| Minimum licensing requirement | 20 Licences | 10 Licences | 20 Licences | 10 Licences |

| Key features | All core financials, AI, Automation | Advanced planning, analytics, & forecasting | All core supply chain, AI, Automation | AI-driven demand planning, analytics, & forecasting |

Dynamics 365 Finance & Operations boasts comprehensive financial management as its core functionality. It offers complete control and transparency over your organization’s accounting, forecasts, cash and budget flow, making your business ready for cross-border transactions and international operations.

Organizations can now run their financial operations more effectively and efficiently with Microsoft Dynamics 365 Finance and Operations. Microsoft Dynamics 365 Finance and Operations can be considered as a modern business solution for organizations to view their financial data comprehensively.

Our team of experts in Microsoft Dynamics 365 Finance and Operations can customize and connect various applications according to your business needs and requirements. Our years of experience and the range of clients we have catered shows that no challenge is big for us.

With decades of experience, you can rely on our expertise for end-to-end Dynamics 365 F&O implementation tailored to your custom needs.

Monitor your business on the go with Folio3 custom D365 Finance and Operations apps.

Ensure smooth operations of D365 finance & operations with our dedicated, 24/7 customer support ready to cater to any unexpected software issues so you remain at ease.

Struggling to connect the dots between your business operations and the D365? Consult our experts of D365 Finance and Operations to make an informed decision.

Whether you are transitioning from Legacy dynamics or migrating from other platforms to Dynamics 365 F&O, we are here to make the process hassle free.

No matter how simple or complex your business operations are, we can customize D365 Finance and Operations according to your business needs.

Gold Microsoft Dynamics partner with solid foundations and experienced professionals

Microsoft Dynamics partner specializing in solutions purpose-built for your unique industry

Microsoft Dynamics 365 Finance and Operations (D365 F&O) is an enterprise resource planning (ERP) solution designed to streamline financial management, supply chain operations, and business processes. It helps organizations improve efficiency, gain real-time insights, and automate workflows.

Some key features include:

D365 Finance and Operations is ideal for medium to large enterprises in industries like manufacturing, retail, finance, and distribution. Businesses looking to automate financial processes, optimize supply chain operations, and improve scalability can greatly benefit from it.

Microsoft D365 Finance and Operations stands out due to its AI-driven insights, cloud-based architecture, seamless Microsoft 365 integration, and flexibility. It also offers industry-specific solutions, unlike traditional ERP systems.

"Microsoft Dynamics 365 for Finance and Operations (D365 F&O) has been divided into two independent applications: Dynamics 365 Finance and Dynamics 365 Supply Chain Management. This division has been made to give companies more flexibility so that they can implement the exact features they require.

Despite this official segmentation, many users and professionals continue to refer to the combined suite as Dynamics 365 Finance and Operations, especially when discussing the integrated capabilities of both applications."

Pricing varies based on licensing, number of users, and specific modules. It typically follows a subscription-based model, with costs starting around $180 per user/month for Finance and $190 per user/month for Supply Chain. Custom pricing applies for enterprise solutions.

Yes, D365 F&O supports integrations with Power BI, Azure services, CRM solutions, payroll systems, and other third-party tools via Microsoft Dataverse and API connectors.

Implementation time depends on business complexity, data migration needs, and customization. A standard implementation takes 6-12 months, while large-scale deployments may take longer.

Folio3 Dynamics is specialized division of Folio3 that specializes in broad spectrum services around Microsoft Dynamics ERP stack.

160 Bovet Road, Suite # 101

San Mateo, CA 94402 USA

Ph: +1 408 365-4638

Email: [email protected]

Cookie Policy | Privacy Policy